Quick inquiry

Drop us a line, and we’ll get back to you within 24 hours.

Ariana Yuan

Digital Operations Manager

Website Planning|Marketing Project Management for Drone Batteries|Scheduled Content Refresh|SEO Optimization

Space-grade safety ensured by multi-level protection, automated manufacturing, comprehensive testing, 24/7 monitoring & big data warning. Max 2000-cycle life via modified cathode/anode/electrolyte to slow capacity fade. Volume energy density >300Wh/kg with advanced materials (high-voltage, cobalt-free, solid-state) and minimalist structure. High consistency from automated sorting/grouping, avoiding barrel effect to boost pack discharge capacity. 24/7 protection via BMS (health monitoring, internal short detection, 90% fire risk reduction) and lifecycle online warning.

Abstract

This article explores how the 18650 cylindrical lithium battery – a mature “small battery” with a diameter of 18mm and height of 65mm – can unlock business opportunities in the fast-growing humanoid robot industry, amid challenges like unmass-produced solid-state batteries and high-cost large cylindrical batteries.

First, it clarifies the 18650’s inherent strengths: a 30-year mature industrial base (global annual capacity over 100GWh), a “triangular balance” of low cost (0.5-1 yuan/Wh, only 1/5 of solid-state batteries), high stability (cell consistency error <3%), and flexible modular design (adaptable to robot arms/torsos, 60% lower maintenance costs than integrated packs).

Second, it verifies the 18650’s adaptability to humanoid robots’ four core power demands: lightweight (15-20% lighter than prismatic batteries of the same capacity), high instantaneous power (10C discharge meeting 2-3kW needs for heavy lifting/squatting), long cycle life (2,000+ cycles supporting 1-2 years of use), and safety (steel casing 3x safer than soft-pack batteries in puncture tests). Compared with 4680 batteries (low yield <70%) and solid-state batteries (high cost, poor low-temperature performance), the 18650 emerges as the “cost-effective optimal solution” for early commercialization, as exemplified by Unitree Robotics’ choice of 18650 for its H1 robot (25% cost reduction vs. 21700 batteries).

Regarding market potential, the global humanoid robot market is projected to grow from ~10,000 units in 2024 to 1 million units by 2030 (CAGR >100%), driving 18650 demand to 100-150GWh (10% of current global 18650 capacity). Despite debates (e.g., “small capacity vs. automotive batteries”), the 18650’s “high unit value (BMS 3-5x pricier than automotive) and fast turnover (1-2 year replacement cycle)” create unique value.

The article further maps business opportunities across the value chain: core-layer cell upgrades (silicon-carbon anodes boosting energy density to 350Wh/kg, full-tab technology improving efficiency by 20%), key-layer customized PACK/BMS (e.g., 20mm-diameter arm PACKs, BMS integrating with robot main control systems), and derivative-layer services (dynamic testing systems, battery rental/swapping, cascade utilization/recycling).

Finally, it addresses challenges (energy density ceiling, lack of standardization, alternative tech competition) and proposes solutions (material/structural upgrades, mid-to-low-end market focus, industry-wide standardization). It concludes that the 18650, as a “mature tech solving phased pain points,” will act as a critical bridge for humanoid robot commercialization, with its industrial value extending via tech migration to other cylindrical batteries long-term.

In the early morning kitchen, a humanoid robot stir-fries ingredients with precision; on the factory assembly line, robotic arms collaborate to complete sophisticated assembly; in the ruins after an earthquake, a metal body navigates nimbly for search and rescue — these are not scenes from science fiction movies, but real epitomes of the accelerated landing of the humanoid robot industry. According to the International Federation of Robotics, the global humanoid robot market is expected to enter the era of million-unit shipments by 2030. However, these “steel giants” carrying human technological dreams face a critical bottleneck: the performance and cost of their power sources directly determine whether they can move from laboratories to thousands of households. At a time when solid-state batteries are not yet mass-produced and large cylindrical batteries remain high-cost, a cylindrical lithium battery with a diameter of 18mm and a height of 65mm — the 18650 — is emerging as a key solution to the energy dilemma of humanoid robots with the stance of a “veteran.” This article will analyze how this “small battery” can drive a hundred-billion-level “large market” from four dimensions: technical adaptability, market potential, business opportunities, and future challenges.

The 18650 battery is not a new product. The “18” in its name represents a diameter of 18mm, “65” a height of 65mm, and “0” a cylindrical shape. This standardized size was established in the 1990s with the rise of laptop computers. After more than 30 years of development, it has expanded from the consumer electronics field to new energy vehicles, energy storage, and other scenarios. The global annual production capacity exceeds 100GWh, and the single-plant capacity of leading enterprises such as EVE Energy and Panasonic can reach more than 10GWh. This mature industrial foundation has laid the groundwork for its cross-border entry into the humanoid robot field.

The competitiveness of the 18650 stems from its “triangular balance” of cost, stability, and flexibility. In terms of cost, relying on a global annual production scale of billions of units, its unit price has dropped to 0.5-1 yuan/Wh, only 1/5 of that of solid-state batteries and 1/2 of that of 4680 batteries. In terms of technical maturity, after decades of process iteration, the consistency error of 18650 cells can be controlled within 3%. Combined with a mature BMS (Battery Management System), it can meet the stringent requirements of humanoid robots that require hundreds of cells in series and parallel — Boston Dynamics’ early Atlas robot prototype achieved stable power output through an 18650 battery pack.

More importantly, it is adaptable in performance and flexibility: the energy density of power-type 18650 can reach 250-300Wh/kg, supporting robots to work continuously for 1.5-2 hours, while the instantaneous discharge rate can exceed 10C, which is sufficient to cope with high-power scenarios such as lifting heavy objects and rapid movement. The modular design allows it to be flexibly combined into battery packs of different shapes, such as long strip-shaped battery packs for robot arms and flat battery packs embedded in the torso. If a single cell is damaged, only the faulty unit needs to be replaced, reducing maintenance costs by more than 60% compared to integrated battery packs.

The requirements of humanoid robots for power sources are comparable to “customizing a heart for an athlete.” Firstly, the lightweight demand: according to calculations by Tesla’s Optimus team, for every 1kg increase in battery weight, the robot’s energy efficiency decreases by 3% and the battery life shortens by 5%. The energy density-to-weight ratio of the 18650 is 15%-20% lighter than that of prismatic batteries with the same capacity, effectively reducing the burden on the “legs.” Secondly, power support: when a robot lifts a 5kg heavy object or completes a squat, the instantaneous power demand can reach 2-3kW, and the 10C discharge capacity of the power-type 18650 can exactly meet this demand. Thirdly, long battery life guarantee: household service robots need to work 4-6 hours a day, and industrial robots need to operate continuously for more than 8 hours. Through multi-cell parallel connection, the 18650 can increase the battery pack capacity to 1-2kWh. Combined with a cycle life of more than 2000 times, it can meet the usage needs for 1-2 years. Finally, the safety bottom line: humanoid robots interact closely with humans, so the battery must have puncture resistance, overheating protection, and explosion prevention capabilities. The steel shell packaging design of the 18650 is more than 3 times safer than soft-pack batteries in needle puncture tests.

Currently, the battery technology routes for humanoid robots are diverse, but the 18650 has particularly prominent advantages in the initial stage of commercialization. Compared with 4680 large cylindrical batteries, although the single-cell energy density of the 18650 is 30% lower, its cost is only half of the latter, and existing production lines can be used without modification. However, the yield rate of 4680 is still less than 70%, making mass production difficult in the short term. Compared with solid-state batteries, although the 18650 has an energy density bottleneck, the current cost of solid-state batteries is as high as 2-3 yuan/Wh, and their low-temperature performance is poor, making them unable to adapt to complex environments such as households and outdoors. Compared with prismatic batteries, the cylindrical structure of the 18650 is more conducive to heat dissipation. When the robot works continuously, the temperature of the battery pack can be controlled within 40℃, which is 8-10℃ lower than that of prismatic batteries, greatly reducing the risk of thermal runaway.

The case of Unitree Robotics is more convincing. Its Unitree H1 humanoid robot launched in 2023 initially tested prismatic batteries and 21700 batteries, but ultimately chose the 18650 battery pack. The reason is that the modular design of the 18650 can adapt to the joint structure of the robot, and the cost is 25% lower than the 21700 solution, while the battery life is only shortened by 15%, perfectly balancing performance and cost requirements.

The explosion of humanoid robots is opening up new growth space for the 18650. In terms of industrial scale, the global shipment of humanoid robots is about 10,000 units in 2024, and is expected to reach 1 million units by 2030, with a compound annual growth rate exceeding 100%. Based on a single robot equipped with a 1kWh battery (requiring about 300-400 18650 cells), the global demand for 18650 in the humanoid robot field will reach 100GWh by 2030, accounting for 10% of the current global total production capacity of 18650. If calculated according to the differentiated configuration of 2kWh for industrial robots and 0.5kWh for household robots, the demand scale will further increase to 120-150GWh.

From the perspective of regional markets, China is the core growth pole. According to the “China Robot Industry Development Report (2024)”, China’s R&D investment in humanoid robots exceeded 5 billion yuan in 2023. Enterprises such as Huawei, Xiaomi, and UBTECH have launched prototypes. It is expected that domestic shipments will exceed 100,000 units by 2025, driving the demand for 18650 to 10-15GWh, equivalent to building 2-3 new large-scale 18650 production lines.

Currently, there are obvious differences in the industry’s perception of the value of 18650 in the humanoid robot field. The bearish camp, represented by Gu Xiaoli, partner of CMC Capital, holds the view that “the humanoid robot battery market is not on the same scale as automotive and energy storage — the battery demand for 1 million robots in 2030 is only 1GWh, and the capacity of a single production line of CATL (Contemporary Amperex Technology Co., Limited) can cover global demand.” However, the optimistic camp sees differentiated opportunities. Morgan Stanley listed batteries as a key link in the industrial chain in its “Humanoid 100” report, and QYResearch predicts that the compound annual growth rate of the humanoid robot battery pack market will reach 28.6%, far exceeding the 5%-8% growth rate of automotive batteries.

The core of the divergence lies in the “choice of market dimension”: if only compared by capacity, the demand for 18650 in the robot field is indeed far less than that in the automotive field. But from the perspective of unit value, the premium space of robot batteries is significant — the BMS of industrial robot batteries needs to have real-time interaction with the main control system, and the unit price can be 3-5 times that of ordinary automotive battery BMS. From the perspective of replacement cycle, robot batteries are charged and discharged 1-2 times a day, requiring a cycle life of more than 2000 times, with a replacement cycle of about 1-2 years, while the replacement cycle of automotive batteries is about 5-8 years. High-frequency replacement will bring continuous incremental demand. This characteristic of “small capacity, high premium, and fast turnover” is exactly the opportunity for the 18650.

The core opportunity of the 18650 in the humanoid robot field starts with the customized upgrade of cells. At the material level, the application of silicon-carbon anodes can increase the energy density of the 18650 to more than 350Wh/kg, meeting the long battery life needs of robots — Far East Battery has launched an 18650 battery equipped with a silicon-carbon anode with a cycle life of 3000 times, which is currently undergoing cooperative testing with UBTECH. At the process level, learning from Tesla’s 4680 full-tab technology, the charge and discharge efficiency of the 18650 can be increased by 20% and the heat dissipation capacity by 30%. EVE Energy has started the construction of a full-tab 18650 production line, which is expected to be mass-produced in 2025.

Customized products for segmented scenarios have greater potential. For low-temperature environments, Far East Battery has developed a -40℃ ultra-low temperature 18650 battery, which can maintain more than 80% of its capacity at -30℃, suitable for outdoor inspection robots. For safety-sensitive scenarios, Panasonic has launched a puncture-resistant 18650 battery. Through thickened steel shells and improved electrolytes, it shows no fire or explosion in needle puncture tests and has been applied in medical service robots.

If cells are the “heart,” then PACK (battery pack) and BMS are the “blood vessels and nerves.” The special structure of humanoid robots brings new demands for PACK design: for the narrow space of robot arms, Sunwoda has developed a long strip-shaped PACK with a diameter of only 20mm and a weight of less than 100g, which can be embedded in the joints of mechanical arms. For the flat space of the torso, CATL has launched a flexible PACK, which can adapt to robots of different sizes through a folding design, increasing space utilization by 40%.

The intelligent upgrade of BMS is another major opportunity. Traditional BMS can only realize power monitoring and overcharge protection, while robots require deep collaboration between BMS and the main control system — for example, when the robot detects that the power is lower than 20%, the BMS can automatically plan the route back to the charging point; when a cell fails, the BMS can isolate the faulty unit in real time to avoid affecting the overall power output. Huawei has launched a dedicated BMS chip for robots, supporting the precise management of more than 1000 cells, which is currently supporting Xiaomi’s CyberOne robot.

With the growth in demand for humanoid robot batteries, the supporting service market will also grow rapidly. In the testing field, robot batteries need to simulate performance under dynamic working conditions, such as 100 consecutive squats and rapid movement. Traditional static testing equipment can no longer meet the needs — Shenzhen Neware has developed a dynamic testing system for robot batteries, which can simulate more than 200 working conditions, and the testing efficiency is 3 times higher than that of traditional equipment. It has been adopted by enterprises such as UBTECH and CloudMinds.

Innovations in service models have greater room for imagination. For industrial scenarios, Envision Energy has launched a “battery rental” service. Enterprises do not need to purchase batteries but pay by usage time, reducing the initial investment cost of a single robot by 50%. For household scenarios, Haier is exploring a “battery swapping service.” When the robot’s power is low, it can automatically go to the community battery swapping station to replace the battery pack, reducing the charging time from 2 hours to 5 minutes.

The circular economy is a long-term opportunity. After being retired from the robot field, 18650 batteries can still be cascaded for energy storage scenarios — for example, an 18650 battery used in a robot for 2 years, with its capacity dropping below 80%, can be disassembled and used in a household energy storage system for another 3-5 years. After final retirement, through the recycling technology of enterprises such as GEM Co., Ltd., the recovery rate of metals such as nickel, cobalt, and lithium can reach more than 99%, forming a closed loop of “production – use – recycling – regeneration.”

Despite its significant advantages, the 18650 still faces three major bottlenecks. At the technical level, the energy density ceiling is obvious — the current maximum energy density of the 18650 is about 300Wh/kg, while the 4680 battery can reach more than 400Wh/kg, and the solid-state battery even exceeds 500Wh/kg. This means that the 18650 is difficult to meet the battery life needs of high-end humanoid robots for more than 4 hours. At the industrial level, the lack of standardization is prominent. The battery interfaces and capacity configurations of robots from different enterprises vary greatly. For example, the battery pack capacity of UBTECH Walker X is 1.5kWh, while that of Xiaomi CyberOne is only 1kWh, and the interface types are incompatible, leading to high supply chain collaboration costs. At the competitive level, alternative technologies are accelerating. The yield rate of 4680 batteries has increased from 50% in 2023 to 70% in 2024, and the cost is expected to drop below 1 yuan/Wh by 2025. The mass production time of solid-state batteries has also been advanced from 2030 to 2027. The window of opportunity for the 18650 may be only 3-5 years.

In response to these challenges, the industry has explored multiple breakthrough paths. In terms of technological breakthroughs, the dual upgrade of “materials + structure” is the key: at the material level, the combination of high-nickel cathodes (nickel content above 90%) and silicon-carbon anodes can increase the energy density of the 18650 to 350Wh/kg. At the structural level, through the “cell parallel connection + PACK layering” design, for example, dividing the robot battery pack into a torso main battery and limb auxiliary batteries, the main battery is responsible for battery life, and the auxiliary batteries are responsible for instantaneous power, which can increase the battery life performance by 20% under the current energy density.

At the market level, differentiated competition is the core. The 18650 should focus on the mid-to-low-end market to avoid direct competition with 4680 and solid-state batteries — for example, consumer-grade household robots are cost-sensitive and have low battery life requirements (1-2 hours), where the cost advantage of the 18650 can be fully exerted. Entry-level industrial robots have high requirements for stability, and the maturity of the 18650 is more attractive than new technologies. It is estimated that the mid-to-low-end humanoid robot market will reach 500,000 units by 2025, accounting for 80% of total shipments, which is the main battlefield of the 18650.

At the ecological level, standardization and collaborative development are key. In May 2024, the China Electronics Standardization Institute, together with more than 20 enterprises including EVE Energy and UBTECH, launched the “Humanoid Robot Battery Standard Formulation” project, planning to release unified standards for interfaces, capacity, safety, etc., in 2025. At the same time, the deep binding between battery enterprises and robot manufacturers has become a trend. For example, EVE Energy and UBTECH have established a joint laboratory to jointly develop customized battery solutions, participating in battery selection from the initial stage of robot design to achieve the optimal adaptation of “robot – battery.”

In the next 1-3 years, it will be the “golden window of opportunity” for the 18650 in the humanoid robot field. At this stage, humanoid robots are mainly used for R&D prototypes, educational research, and commercialization in specific scenarios. The demand for cost and stability is far higher than for extreme performance. The mature supply chain and cost advantages of the 18650 will become core competitiveness. It is expected that by 2026, the market share of the 18650 in the humanoid robot battery market will exceed 70%, mainly used in household service robots, industrial inspection robots, and other scenarios, with a market size exceeding 5 billion yuan.

The core strategy at this stage is “rapid penetration”: battery enterprises should accelerate cooperation with robot manufacturers to launch standardized battery packs, reducing customer selection costs. At the same time, layout supporting services such as testing and maintenance to build an initial “product + service” ecosystem. For example, Panasonic has set up a “Humanoid Robot Battery Service Center” in Shenzhen, providing one-stop services including battery testing, maintenance, and recycling.

From 2027 to 2029, humanoid robots will enter the stage of large-scale commercialization, and mid-market demand will explode. The 18650 needs to consolidate its position through system-level innovation. At this stage, battery enterprises should deeply collaborate with PACK and BMS enterprises to launch an integrated “cell – PACK – BMS” solution — for example, EVE Energy, together with Huawei and Sunwoda, has developed a “robot energy system,” integrating cells, flexible PACK, and intelligent BMS into a single module. Robot manufacturers do not need to design battery systems separately and can directly integrate them, shortening the R&D cycle by 60%.

At the same time, the 18650 should delve into segmented scenarios. For example, medical service robots need to have anti-infection and low-noise characteristics, so sealed battery packs and silent heat dissipation designs can be developed. Outdoor rescue robots need to have waterproof and drop-resistant characteristics, so PACK with IP68 protection level can be adopted. Through scenario-based innovation, the 18650 can establish a moat in the mid-market and is expected to maintain a market share of more than 50% by 2029.

After 2030, with the maturity of 4680 and solid-state batteries, the market share of the 18650 in high-end humanoid robots may decline, but it can still find a niche in segmented fields. In distributed power scenarios, such as small power units in the head and hands of robots, the compact size of the 18650 is more suitable than large cylindrical batteries. In cost-sensitive scenarios, such as low-end industrial robots and educational robots, the cost advantage of the 18650 will continue.

More importantly, the production lines and technical experience of the 18650 can be smoothly migrated to cylindrical batteries of other specifications. For example, EVE Energy’s 18650 production line can produce 21700 batteries by adjusting the mold, with an equipment reuse rate of 80%. Panasonic’s 18650 BMS technology can be directly applied to the management system of 4680 batteries. This “technology migration capability” will continue to extend the industrial value of the 18650, transforming it from a “transition solution” to a “technical cornerstone of the cylindrical battery ecosystem.”

The opportunity of the 18650 in the humanoid robot field is essentially a commercial model of “mature technology solving phased pain points.” It does not have the cutting-edge gimmicks of solid-state batteries nor the grand narrative of 4680 batteries, but relies on the comprehensive advantages of cost, stability, and flexibility to become the “optimal solution” in the initial stage of humanoid robot commercialization. This logic of “not pursuing extreme technology but pursuing just the right fit” is an important law of technological industry evolution — just as lithium batteries replaced nickel-hydrogen batteries and LEDs replaced incandescent lamps, it is often not the most advanced technology that wins the market, but the technology that best adapts to current needs that achieves a breakthrough.

For enterprises, the enlightenment of the 18650 lies in “identifying the phased positioning”: battery enterprises should focus on the mid-to-low-end market and establish advantages through customized upgrades and service innovations. Robot manufacturers should fully leverage the cost advantage of the 18650 to accelerate product landing and seize market share. For investors, it is necessary to jump out of the inherent thinking of “advanced technology = high value” and pay attention to enterprises with “scenario-based innovation capabilities” in the 18650 industrial chain, such as customized PACK manufacturers and intelligent BMS developers.

In the future, when solid-state batteries are mass-produced on a large scale and the cost of 4680 batteries drops significantly, the 18650 may gradually withdraw from the mainstream stage of humanoid robots, but its “bridge role” in the initial stage of the industry will be remembered — it is this “small battery” that, with a mature attitude, has leveraged the “large market” of humanoid robots and paved the way for the commercialization of the entire industry. This kind of commercial wisdom of “achieving great things through small efforts” will continue to provide inspiration for innovation in the technological industry.

● Appearance: Cylindrical

● Shell: Nickel-plated Steel Shell

● Weight ≈ 46g

● Diameter < 18.5mm

● Height ≤ 65.3mm

● Appearance: Cylindrical

● Shell: Nickel-plated Steel Shell

● Weight ≈ 69.5g

● Diameter < 21.7±0.3mm

● Height ≤ 70.8mm

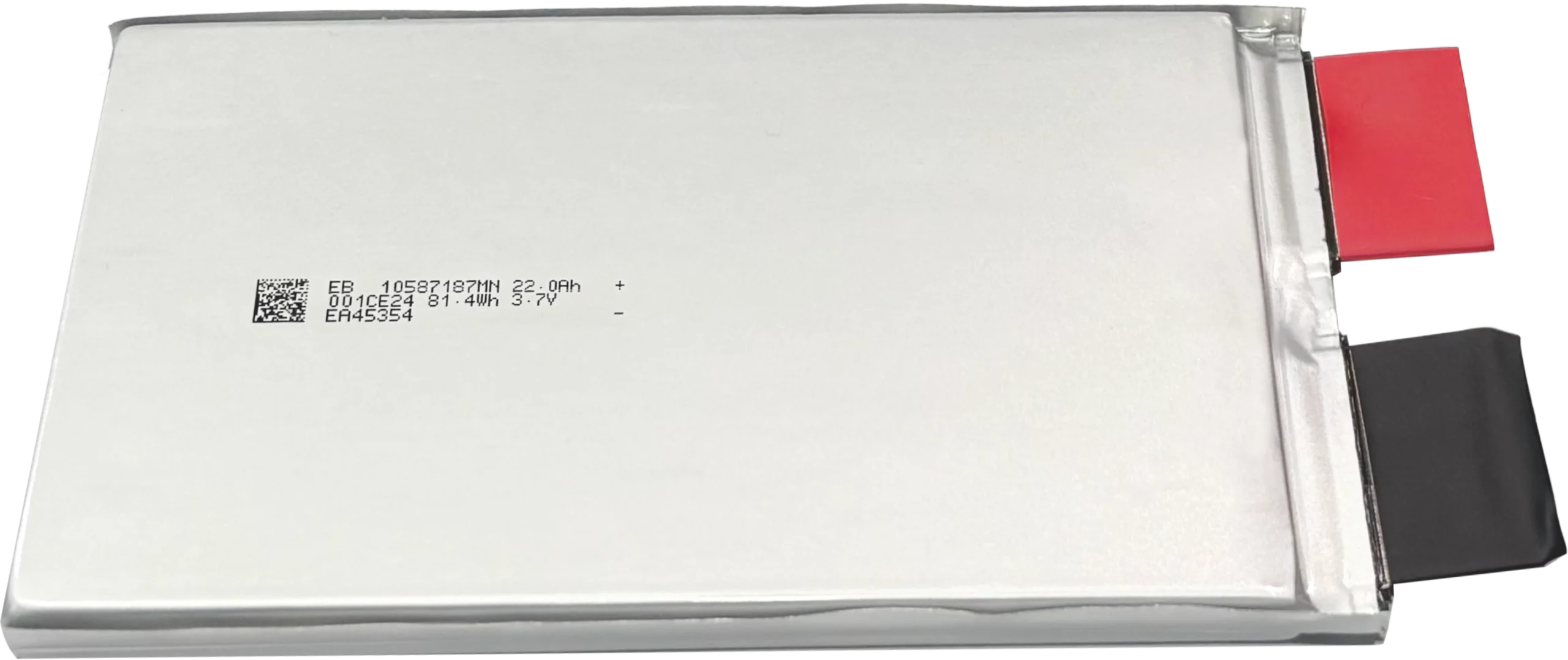

Lithium iron phosphate, featuring high safety, long lifespan, excellent cycling performance, and being the main focus for high-rate and wide-temperature application scenarios.

Lithium cobalt oxide has a very high energy density and a stable discharge plateau. It is mainly used in consumer electronics and has applications in fields such as UAV.

Nickel-cobalt-manganese ternary lithium, with high energy density, excellent rate and low-temperature performance, balanced performance and cost.

Drop us a line, and we’ll get back to you within 24 hours.

Website Planning|Marketing Project Management for Drone Batteries|Scheduled Content Refresh|SEO Optimization

Website Planning|Marketing Project Management for Drone Batteries|Scheduled Content Refresh|SEO Optimization